In an era of machines and Artificial Intelligence, the traditional form of banking has taken the back seat, when compared with tech-savvy Fintech players of the industry who are keen to adapt latest technologies to keep up.

As per market experts, it goes without saying that AI will empower Banking Services, redefining operations by innovating products and services beyond the conventional norm. This eventually perks up customer experiences. Leveraging advanced technologies, human workers will be replaced with sophisticated algorithms.

Such a competitive edge can only be achieved by banking corporations by embracing AI and weaving it into strategic business decisions for maximum profits.

AI can double Business Profits

AI professionals quote; there are three primary ways the introduction of AI in the Banking Sector can shoot business profits.

Here they go:

- Enhancing contemporary Profits and Loss levers

- Identifying new growth patterns

- Delivering the Digital bank

But the question is: How AI can achieve this objective? The answer to it is by:

- Profiling and Customer Segmentation– Being aware of the financial profile of all the customers helps banks to jack up the expenditure and income for next month, and maximize revenue.

- Customer Spending Pattern Analysis- Typically, banks have adequate data about a customer’s flow of income every month, net savings and utility expenses. With the help of this model, banks can conduct a risk assessment, loan screening, cross selling of financial products, and mortgage evaluation.

- Evaluating Creditworthiness- Determining whether an individual is likely to be a defaulter and estimating the amount that can be offered to him/her.

- Transaction Channel Identification- With the help of AI, banks can determine if a customer is likely to keep or withdraw money on payday. The latter customers can be pitched for short-term investments.

All the above-mentioned objectives have one thing in common- SPIN Strategy AI Models.

SPIN’s AI models are banking Operation-Focused

At SPIN, we provide a range of AI and ML learning tools for a host of operational applications for financial institutions. Such tools include:

1. Risk assessment, compliance & reporting

Comprehends the spending pattern and analyzes previous credit history to assess the risk of issuing a loan to a customer.

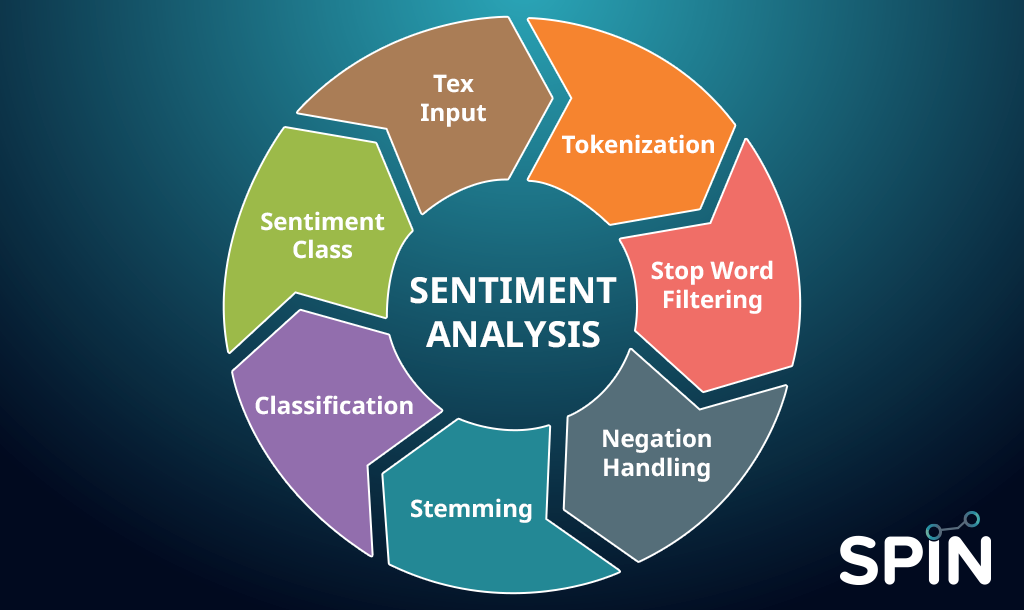

2. Sentiment Analysis:

Customer view and market rumors play a significant role in business, and with NLP it is easy to comprehend customer sentiment and its impact on the enterprise.

3. Propensity Modeling

Uses historical data to make business predictions by directing consumers to the right messages and website locations.

If that’s not all, here are a few factors to conclude the fact that SPIN Models are a boon for the banking sector.

Read More for Related Blogs:

SPIN for Banking Services: Here is why

- Communication: We keep our customers in the loop with necessary and crisp data, perfecting the art of delivering the right solution to the right clients at the right time.

- Minimal expenses: No fluctuating invoice rates for our clients. We maintain a simple flat monthly rate.

- Rate: Simple monthly pricing for your business requirements at easy rates.

- Experience: Maintaining optimum performance standards, our experts use AI-models for Data Integration, Conversion Optimization, Data Analysis, etc.

- Data Integration: We combine data from multiple digital marketing platforms to prepare customized reports to generate a holistic understanding of your brand’s ROI and growth.

- Predict Churn: Using AI and ML, SPIN identifies segments of the customer base who are about to leave you for your competitor brand.

The result of using SPIN AI Models for Banking Decisions- Improved decision making for credit and loans.

Here is a real-life scenario- Case Study

The Client- The client offers financial services and technical support in a bid to increase productivity, boost innovation, and add economic integration.

The Issue– The bank officials have diverse knowledge on various topics, and have shaped themselves as SMEs of certain topics. They share their knowledge from different geographical locations. The client wanted a single integrated knowledge management platform for individuals to reach out to these SMEs for a certain project in hand.

The Solution- SPIN worked with the client to deploy a cognitive computing application that would include a virtual agent to comprehend Natural Language request inputs and utilizes cognitive deductions to answer the queries.

In a bid to simulate human-like conversations between the systems and the users, SPIN leveraged Advanced Text Analytics including entity extraction, keyword extraction, emotion analysis, sentiment analysis, etc.

The Result- The bank now has the faith that productivity across the globe will hit the roof due to the easy availability of SMEs. This will boost operational efficiency by 30%-40% and expand cross-broader collaboration and employee management too.

To conclude with

We are more than happy to help Banking Organizations with AI and Data Analytics services. Guaranteeing a solution that caters to clients’ needs and budget, at SPIN we ensure to provide excellent value for businesses.

For more info, visit: https://www.spinanalyticsandstrategy.com/

Read More for Related Blogs: